I’ve been asked this question a couple of times and since my last blog post this number has only increased. Facts are facts: Until basic terms are not clarified and there are people who mix up blockchain and bitcoin or people who think blockchain only means cryptocurrencies, then my ANSWER IS NO. As we know, nowadays the most important things in the financial system are safety and safe transition when it comes to changing the system or technology.

Let’s ask ourselves the big question: what is a blockchain exactly? From business point of view (which is never told clearly of course) the most important problem (that blockchain is here to solve) is a 40 years old problem: how can we tackle the issue of credible storage, processing and access of data on a software level? Oh wait, my bad. What do we mean by credible?

1. The system not only guarantees irrevocability when storing data, but also provides data with an trustworthy time stamp. This way, thanks to these digital signatures, inviolability of data is obvious.

2. Second, it is required that data entered by the user arrives to the system trustworthy (credible recording) and then it undergoes credible processing.

3. What is credible data processing? It is that source code of the program that processes data, makes sure that the data and the program itself have a digital signature and an credible time stamp and it gets stored on blockchain (these are briefly smart contracts). This way the processing program becomes credible, which means there was no unauthorized data modification.

4. However, there is another important point in credibility, and it is data accessibility. Under no circumstances can the case happen that an unauthorized person or program code gets access to the stored data. Fortunately, blockchain technology provides a solution for all these concerns.

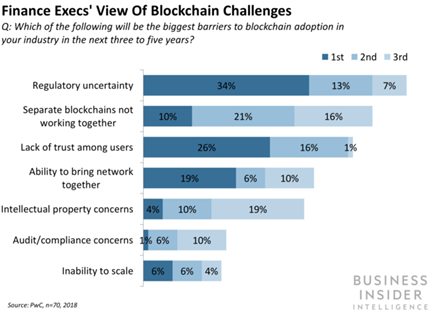

Back in 2018, the Business Insider made a survey asking the public about the biggest burden of the adaption of blockchain based solutions in the financial world. In the end, uncertainties of the regulatory environment got the most votes:

This outcome is perfectly understandable from the business side: if we divide different assets to crypto currencies (stable coins) and to the digitalized versions of already existing assets (to make it simple like we stored money or value-bills on a blockchain based accounting system), it becomes clear that there is a huge gap in the regulatory environment of cryptos in almost every country concerning digital assets (By the way, SEC has newly released and article about the analysis framework of investment contracts). Nevertheless, we must notice that it is not the blockchain technology that must be regulated. A technology cannot be "controlled", or at least not the way that most people think. Every accounting and inventory management system have already stood up for the use of blockchain technology, because as soon as we digitalize an asset (an existing stock, money or other things) we feel the necessity of the technology itself. What is the main point then? Blockchain technology must not be mistaken for any new assets that were created with the help of it. Moreover, steps towards the regulation of new assets must be made by the authorities, central banks, financial organizations and governments.

Me, as a customer would like my bank to run the accounting system on blockchain, thus providing credible data recording, processing and access. Do I wish too much? I don’t think so. As for my personal opinion, big corporations providing financial services should adapt the new technology as soon as possible if they want to keep up. It is not about the positive sides of having immediate transactions between banks due to BC technology: that already exists. Yes, I admit it could be better, but still it fastens and helps immediate transactions between banks in one way or another in most countries. Then why do we need THE solution? When providing a clearly financial solution, it is not enough to use the old technologies. It is a must to use blockchain based solutions. Why? First, due to its credibility it comes with higher safety. Second, from the service provider side it provides:

· error reduction: with the use of smart contracts, mistakes made by humans during transaction could be reduced dramatically.

· expense reduction: with digital solutions, less human resources are needed. Just think about the possibilities of digital documentation and contracts.

· fraud detection: helps to investigate transactions. As transactions form a chain, when it comes to a new transaction, possible money-laundering can be detected almost immediately.

· risk reduction: every risk type can be reduced with the help of a blockchain-based accounting management system.

My previous blog post already mentioned the opinion of giant corporations: the technology is too complicated and currently unable to solve challenges. However, my personal opinion is that it can already meet the expectations. Our team has already accomplished this at BlockBen. Yes. We created a platform which is a credible, blockchain-based accounting and inventory management system. But this is not only about creating a technology, it is much more. Real problems of business life came into the picture and we created a blockchain-based solution to all these problems. The most important lesson is the following: Do not listen to those, who say it’s impossible. It is possible. Is it difficult? Of course, it is terribly difficult from both IT and business side. When an IT specialist claims it is too complicated, the only thing we can do is to reveal to the whole world we have already accomplished the task: our solution meets the requirements of the modern era. It provides digital, credible recording, processing and accessibility. The platform itself provides credible accounting, record and digital contract management in line with PSD2, GDPR, eIDAS regulations. The correspondence to soon-coming E-Privacy completing GDPR is also in progress.

So, what is the conclusion here? The replacement of accounting systems took place, however the software solution is STILL based on old technology. The real question is: will banks undertake the change of a new core banking system, or will they be able to create their own, blockchain-based digital bank? They have the money for that, there is a demand and there are hundreds of reasons why it is a “must” (the most important are risk and expense reduction) from IT, business and the stakeholder’s side. If there is no commitment to save problems, competitive service providers will appear on the market with a payment service provider license. Thus, they will not only overtop traditional banks, but with a credible blockchain-based accounting and inventory management system they can even rock their markets.