I am reading more and more “clickbait” articles in different mediums with headlines like “blockchain technology has come to an end” or “Blockchain hype is dead” and so on. As you already know, I love to take a peek behind the curtains… the truth is out there 😊. However, before doing so, let’s clear what I am exactly talking about.

There are several interesting articles that worth reading in this topic before examining the other side. For instance, Cathrine P. Bessant, Chief Operation and Technology Officer at Bank of America, expresses her skepticism towards public blockchains, but at the same time she is convinced about the usefulness of private solutions.

Moving forward, the World Bank in one of its articles writes about blockchain not providing things that were promised. To be more exact, it says: “Tech can look big and flashy, and like it can solve all our problems ... but the Big Mac burger never matches up to the one in the ad”. At the end of the article, the message is well concluded: “Show me the use case”. I will reflect on this later. In my own interpretation the main and most relevant question is why a financial organization needs this technology.

If we continue reading, we will find the news that one of Australia’s Big Four banks, ANZ is not a hundred percent satisfied with the technology either. The article reveals they did not choose a good option to solve their own problems. I truly believe that properly specialized solutions need to be found for each and every individual problem of different cases. We must not come at screws with a hammer, just because they look like a big pin from the distance.

My personal opinion is that it’s quite surprising to read such opinions from these giant corporations. Let’s take a look at the most common problems:

· rapidity

· public-private blockchain

· use case

Rapidity is really a soft spot of public blockchain solutions. The main reason is that consensus must be made between many “nodes” (servers) on a distributed system during the creation of a new block (during the authentic storing of new transactions). However, we should not forget that after abandoning the Satoshi principles a new blockchain type was born, the private or in other words permissioned blockchain solution. This solution is far from being slow. Compared to Bitcoin’s 5-10 minutes transaction validation time, rapidity is significantly higher on private blockchains (we can even read about 7000 transaction per second solutions). Here, I would like to note that the blockchain system of the BlockBen platform in basic configuration, even without proper scaling and orchestration, is able to pass 2000 transactions per second. It may not be the fastest system currently, but system and configuration optimizations are in continuous progress. However, I will discuss this topic in another article (we will have some pleasant surprises!) because this is not the reason why we have gathered here today. What is interesting, yet an unsolved situation is the possibility of parallel processing on the blockchain system. Supposing it is even an option…

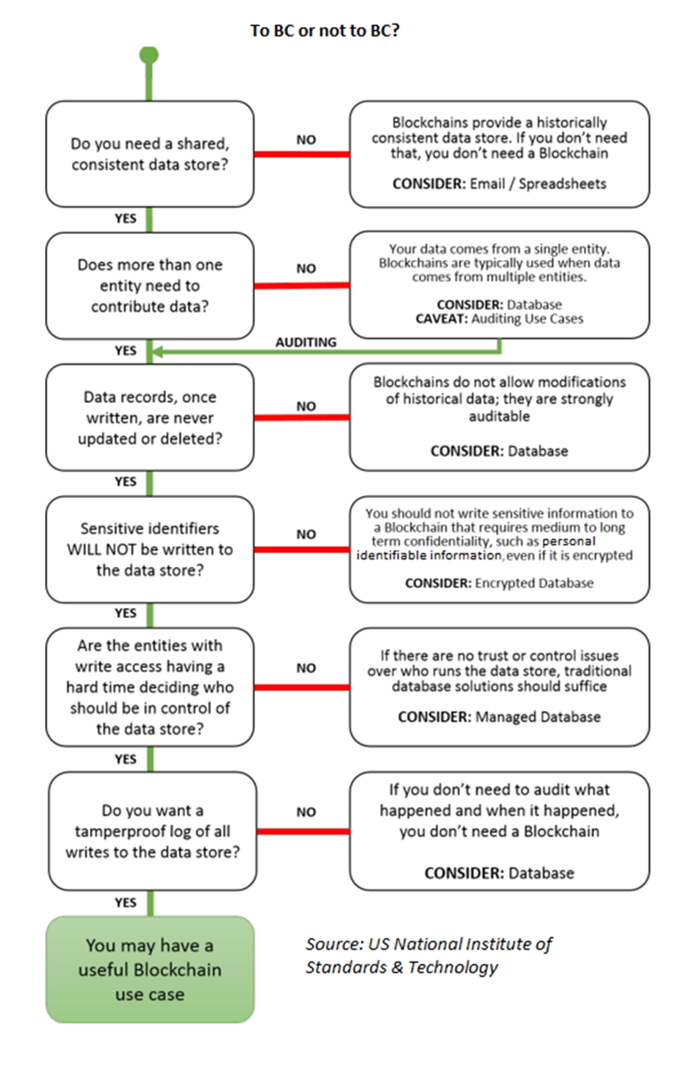

When choosing between public and private blockchain solutions, it is essential to precisely know the business needs and what we want to achieve. So it comes hand in hand with use cases. This present list of queries was made with the aim of guiding business-oriented people towards the right choice:

It is important to highlight that the questionnaire have missed out the most important question: Do you need authentic data storage? Some must bend their brows now, as a similar question can be found on the picture: “Data record, once written, are never updated or deleted?”. I get it, but we must acknowledge that authentic storage means more, as not only the protection of data is at stake, but reception of data and its processing and access.

The first big flow of blockchains has come and gone. No, I don’t say that. Some does.

Concluding facts: many consider BC technology too difficult, even though they used it in cases where it is not a solution to a given problem. At the same time, we have some utopian considerations about BC technology solving every single problem, whereas in real life it only pays the informatic debt of the last 40 years: provides authentic data storage. According to this, we are no longer talking about legal previsions but about IT ones, in terms of data processing, storage and access. We have arrived to a point where we can really feel safe our possessions in a blockchain based accounting system. Knowing what we know, the real question is not the use case, but the following: Why don’t we still have a blockchain based authentic data storage solution behind every data storing software?

Now, I would like to refer back to my previous article. Business, most and foremost must understand technology to make the right decision when it comes to technical use cases. Now it is clear that more and more people realize the positive characteristics of blockchains but only a few understand why it is NECESSARY and a must have from the business side. Finally, neither chivalry nor blockchain is dead, we only need to understand the technology better to create crucial and groundbreaking solutions.

To be continued, stay tuned and get some popcorn, my next post will blow your mind…